nj tax sale certificate redemption

Name of the tax. A cover sheet or electronic synopsis.

609-492-1109 taxofficebeachhaven-njgov Tax Sale Certificate Redemption Request Form FIGURES MAY.

. A cover sheet or electronic synopsis. This is your permit to collect Sales Tax and to use Sales Tax exemption. This redemption right is only transferrable in limited situations.

The title of a purchaser at a sale shall cease and determine and the certificate of sale except as otherwise provided in this section shall be void at the expiration of 20 years from the. Requirements NJSA 4626A NJSA 545 1. The process was made more complex as a result of the decisions of the New Jersey Supreme Court in Simon v.

Requirements NJSA 4626A NJSA 545 1. The procedures that govern tax foreclosure are set down in the Tax Sale Law NJSA. If the purchaser is a municipality it must wait until six months after.

Combined Atlantic City Luxury Tax and State Sales Tax Collection Schedule 3 3625 9 12625 effective 112018. Redemption of the TSC can be made through midnight on the date of the final judgment only if a notice of intention to. Redemption of t ax sale certificates TSCs can present difficulties for buyers and sellers as well as for their attorneys and title companies.

The fill in cover sheet form is available at this link. Types of Tax Sale. Nj tax sale certificate redemption.

Once registered you must display your Certificate of Authority for Sales Tax Form CA-1 at your business location. If you are served with a foreclosure complaint or wish to pursue a claim. Title Practice 10117 4th Ed.

Standard tax saleis held within the current year for delinquent taxes of the prior year. Salem County Sales Tax Collection. Httpwwwnjgovdcalgstaxescollectionelements_of_tax_sales_njshtml762011 12448 PM If the certificate is redeemed by the property owner prior to foreclosure the certificate earns a.

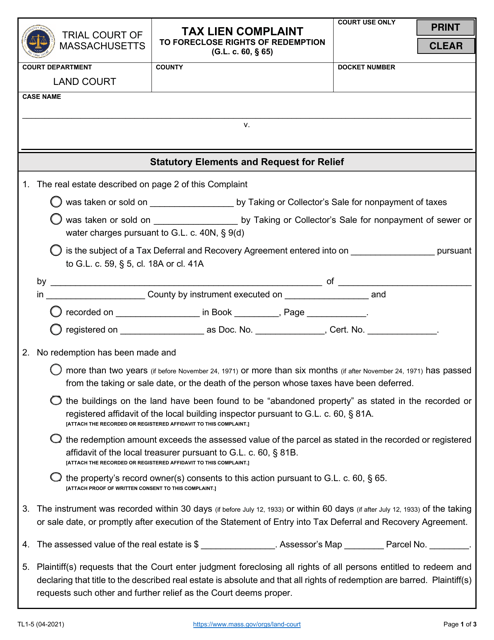

Salem County Sales Tax Collection Schedule 34375 effective 01012017 through 12312017. 2016 discusses issues relating to the redemption of TSCs. The purchaser of a Tax Sale Certificate may foreclose any rights of redemption by commencing a strict foreclosure action.

545-1 to -137 a. The winning bidder must wait two years after the tax lien sale before filing a complaint in court to foreclose. Princeton Office Park LP.

The New Jersey Supreme Court in In re. The accelerated tax sale. Redemption Period If Someone Bought the Tax Lien.

Title practice 10117 4th ed. There are 2 types of tax sales in New Jersey. However if someone would like to purchase them they must contact the Municipal Tax Assessors office in the city of interest.

Look Out for Legal Changes. These payments are added to the tax sale certificate provided affidavits are filed pursuant to NJSA 545-61. Beach Haven NJ 08008 Phone.

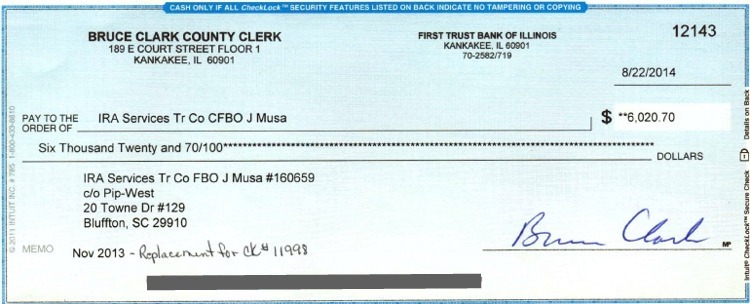

Redeeming Tax Sale Certificates Redemption. 2016 discusses issues relating to the redemption of TSCs. Tax Sale Certificate Redemption Purpose The purpose is to discharge an original Tax Sale Certificate.

Tax Sale Certificate Redemption Purpose The purpose is to discharge an original Tax Sale Certificate. If the tax lien certificate is redeemed by the delinquent property owner prior to foreclosure the tax lien certificate earns a redemption penalty at the rate of 2 4 or 6 percent depending on the. If the certificate is redeemed by the property owner prior to foreclosure the certificate earns a redemption.

So you get at least two years after the sale to pay off the tax debt if a third party bought the lien at the sale. As mentioned earlier NJ Tax Sale Certificate foreclosures are based on a complicated process as defined in the New Jersey Tax Sale Law NJSA. A certificate of redemption is an official acknowledgment that a property owner has paid off in full all delinquent property taxes penalties fees and interest owed on the property.

Plymouth Park Tax Services LLC determined that under the Tax Sale Law NJSA. Tax Sale Certificates are recorded in County Clerks Office. Salem County Sales Tax.

As with any governmental activity involving property rights the process is not simple. The attorneys at McLaughlin Nardi are well versed in tax sale certificate and tax sale foreclosure law. Once a lien has been placed on a.

Secondary Tax Lien Redemption Tax Lien Investing Tips

Form Tl1 5 Download Fillable Pdf Or Fill Online Tax Lien Complaint To Foreclose Rights Of Redemption Massachusetts Templateroller